Bitcoin plunges into awakening

This Wednesday, the Office for Economic Analysis (Bea) of the United States Ministry published its preliminary estimate of GDP for the first quarter and we can say that the reports were not good. According to the agency, the US economy decreased by 3 % compared to the previous year compared to the growth prognosis. This slowdown naturally had an impact on risk assets and especially bitcoins and other cryptocurrencies.

This is the first contraction of the US economy since the first quarter of 2022. The main officials of this slowdown are two key axes of Trump’s economic policy: an increase in imports and reducing government expenditure. In fact, imports in the first quarter increased by 41.3 %, while public expenses have decreased. When calculating GDP, imports of imports lead to a decrease in GDP, as well as a reduction in public expenditure negatively affects economic activity.

The GDP formula is as follows:

GDP = Consumption (C) + government expenditure (G) + investment (i) + export (x) – import (m)

At a time when this article is written, the market meeting in the United States is still by far the end, but the effects of this announcement are already visible in the markets. The S&P 500 has a decrease of 1.07 %, while harder in autumn is currently over. The situation is even more disturbing for Nasdaq, which has seen a decrease of 1.32 %.

In Europe, the reaction was similar. Although the CAC 40 started up the day, it currently fell by 0.16 %. DAX30 and Eurostoxx 600 monitor the same trend, with a decrease of 0.29 % and 0.16 %.

Bitcoin seems to respond to this message. After the announcement, the course increased from 95,178 to $ 93,000. Since then, however, the asset has increased to $ 94,000.

Are we witnessing “nasdaquilization” BTC?

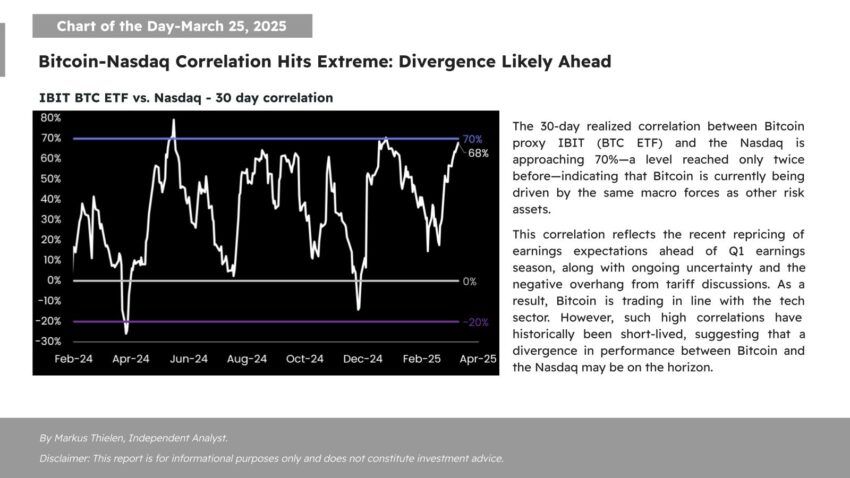

Since 2021, Bitcoin has been developing an increasingly synchronized way with risky active ingredients of Wall Street, especially with Nasdaq. At the end of March, Matrixport published a study indicating that correlation between Bitcoins and Nasdaq reached a peak of 0.70 for 30 days. A high correlation that challenges the traditional role of bitcoins as a refuge. Theoretically, bitcoin should serve as a refuge during the risk of risk values, but reality seems to be much more complicated.

Since Trump has passed the impact of customs prices, but with less harmful consequences than NASDAQ technological actions. If we compare the performance of both active components since the beginning of the year, we note that Bitcoin has exceeded the American technological index: -8.91 % for NASDAQ 100 (NDX) compared to +1.05 % for bitcoins.

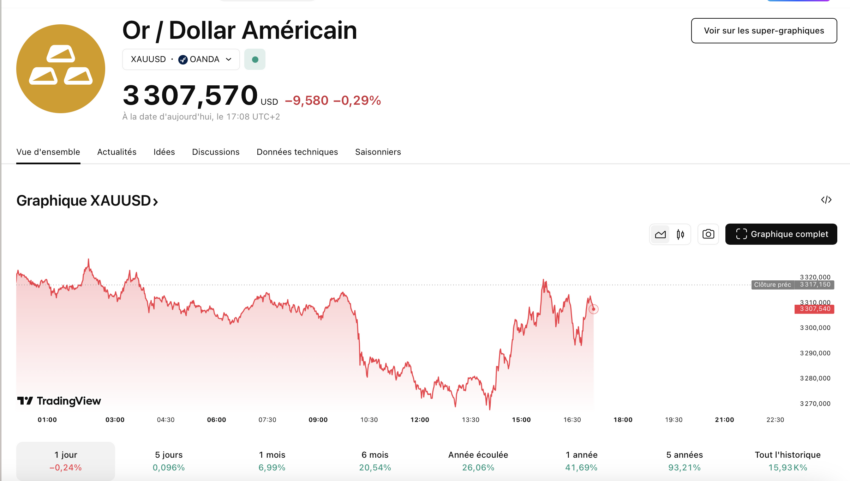

Compared to traditional assets of refuge, however, the growth of bitcoins remains modest. For example, gold recorded an increase of 26.02 %in 2025. Other precious metals have also seen a similar increase. In addition, the main currencies (with the exception of the dollar) showed good performance in the face of economic uncertainties.

So if Bitcoin tries to do the same as gold, it was halfway, stuck between Nasdaq and gold.

Morality History: When the economy throws itself, even bitcoins prefer to jump with Wall Street!

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.