CHATGPT context:

After the successful April month AI expects to continue in May. Obviously, it is not the only one that shares this opinion.

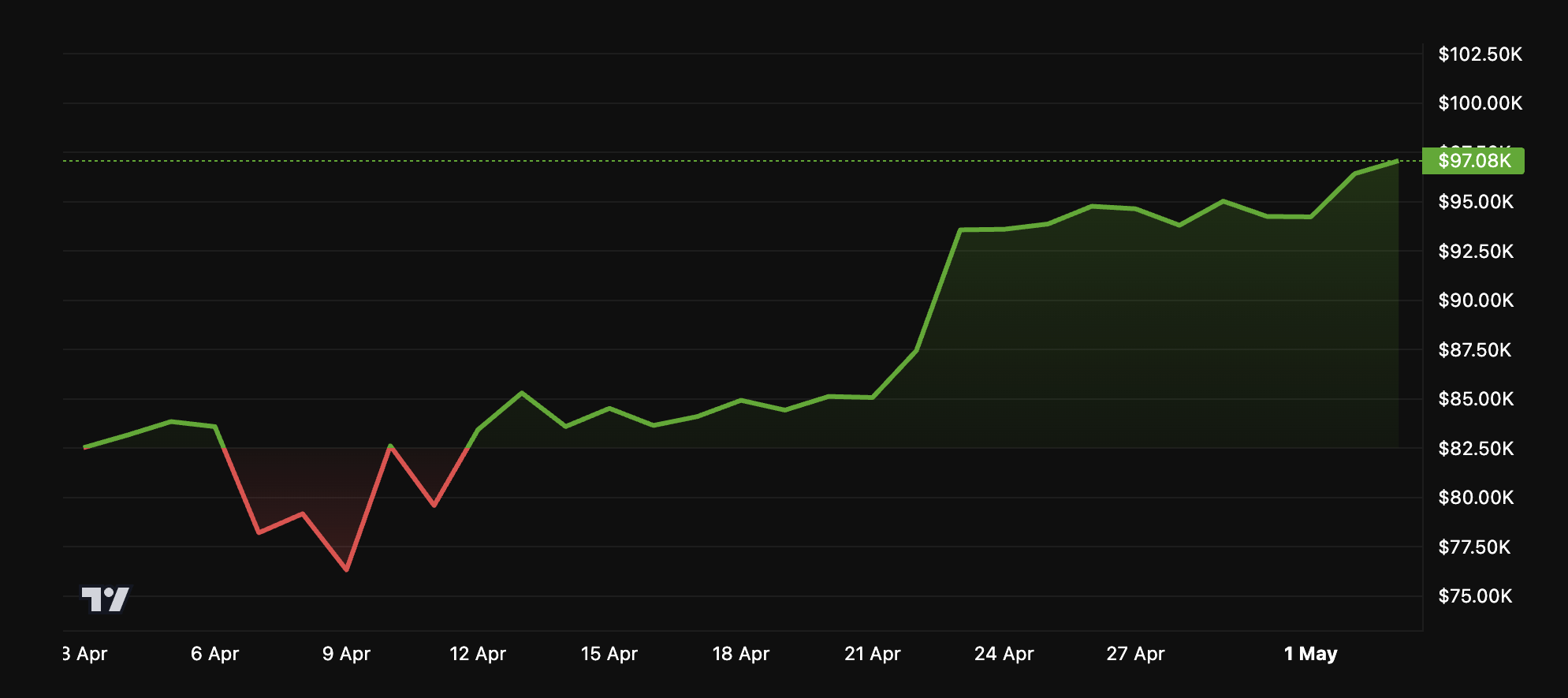

This occurs, while Bitcoin continues its regenerative rally after the cavities in early April and an increase of 14.6 % in the last 30 days.

Is Bull Run Back for Bitcoins?

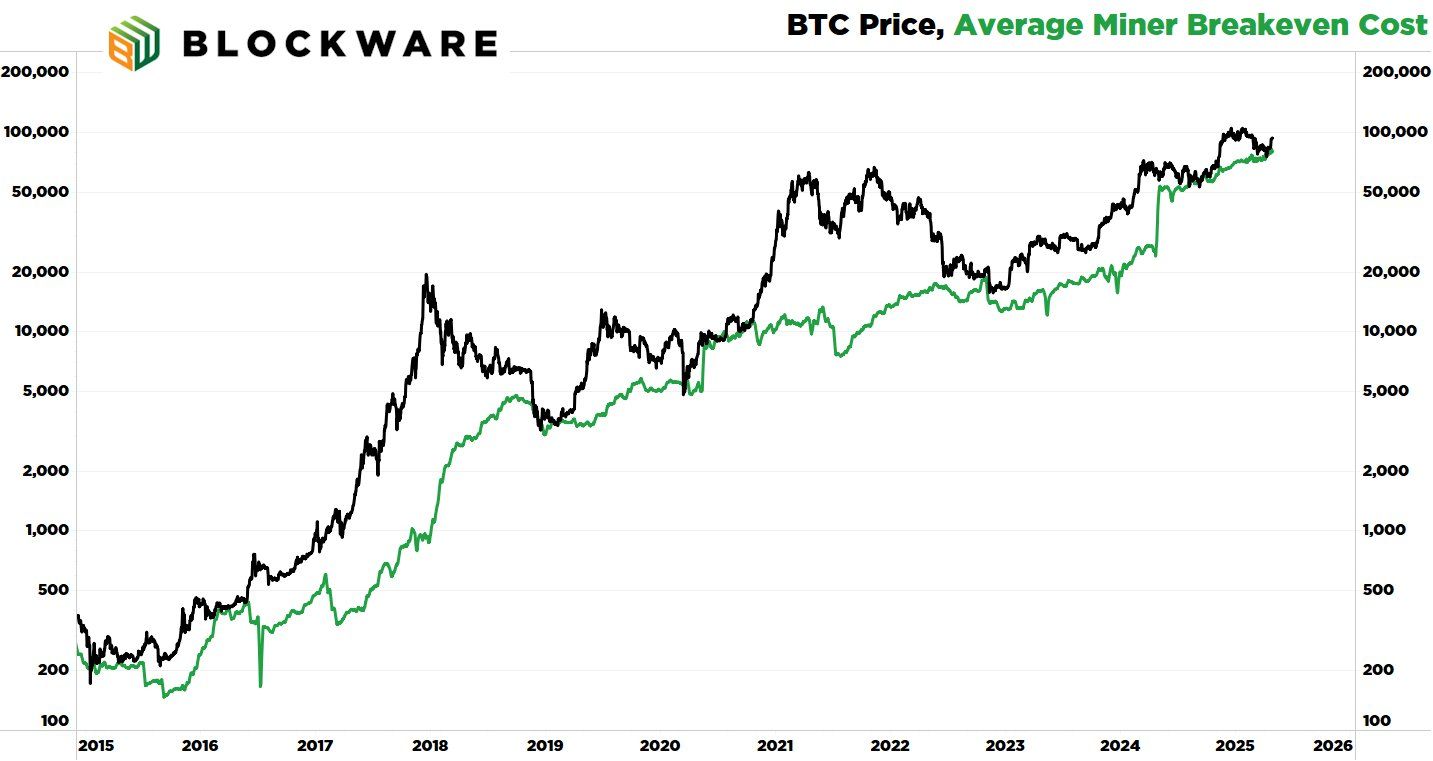

According to an analyst and founder Wim Media, Robert Breedlove, Bitcoin could be at the dawn of the Bull Rally due to the average cost of profitability of the Blockware minor team.

He noted that the price generally does not remain below this average for a long time. In fact, because it represents a threshold for which minors can stop their operations if they are not profitable.

“In the rational economy, assets are rarely negotiated under their production costs,” Breedlove said.

He stressed that the index identified with the accuracy of six cavities in 2016 to 2024. Now the index indicates the immediate increase in the prices of bitcoins.

Macromicro also strengthens this. At the time of writing, the mobile diameter (MA) was for 30 days after ratio/price BTC 1.05.

This tells us that minors last month worked with a loss. As a result, this could potentially increase prices, with minors with losses that would reduce their activities, thereby limiting the offer.

The price model based on Bitcoin hashrate, evaluates the value of BTC as the function of the historical relationship between its price and has been extinguished. This kind of analysis also strengthens ascending perspectives.

In particular, the analyst Giovanni expressed that the model is currently at the level of support for the largest cryptocurrency in the world.

“The fact that the BTC -based BTC is at the level of support means that we have probably achieved any local cavity,” the analyst said.

Other market signals also strengthen the hypothesis of the potential Haussier rally. Breedlove stressed that the holders of the long -term point of view have accumulated around 150,000 in the last 30 days. This suggests reduced sales pressure between $ 80,000 and $ 100,000.

Since fewer and fewer people are located at these levels, the price could undergo pressure increase. Especially because if the demand remains strong, the offer in circulation is reduced.

“In principle, the price of bitcoins responds to supply and demand. After raising prices, parts of previously inactive movements on the chain. On the other hand, long -term holders will accumulate more parts for long periods of stagnation or a fall in prices. »» »» »» »» »» »» »» »» »» »» »» »» »» »

More liquidity for risk assets?

In parallel, the money supply in trust (m2) expands the capital of available capital to invest in bitcoins.

“And not only the liquidity in USD increases. The liquidity of all trust currencies increases, while Bitcoin is all over the world,” Breedlove said.

Recently, Beincrypto also emphasized several bulls for BTC. The demand for this part became positive again and included an increase in interest and purchase around Bitcoins.

In addition, the value market ratio (MVRV) was reflected from a historically significant diameter to 1.74. This movement has been shown to be a reliable indicator of the first phase of the Bull market for BTC.

Until now, BTC price performance was very remarkable in the middle of these bulls. Despite passing below $ 75,000, the price then improved upgrades at the beginning of April.

Over the last week, the price of bitcoins has increased an increase of 4.3 %. At the time of writing, the token was negotiated over $ 97,000, which recorded daily profits.

Morality History: The lights are green, Bitcoin must now start the first.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.