Context:

Solana experienced good support in April well supported by growing activities in her blockchain.

These positively associated with blockchain changes led to ground prices, with a token that won by 16 % in 30 days. While the network shows no signs of slowing, Solana could continue his upward trajectory in the short term.

Network activity explodes on the solana

With the user’s activity on the user’s side, Solana recorded the number of daily transactions rising. According to Artemis, blockchain has been processing more than 99 million transactions since the beginning of April. This represents a favorable development of 12 % compared to the previous month.

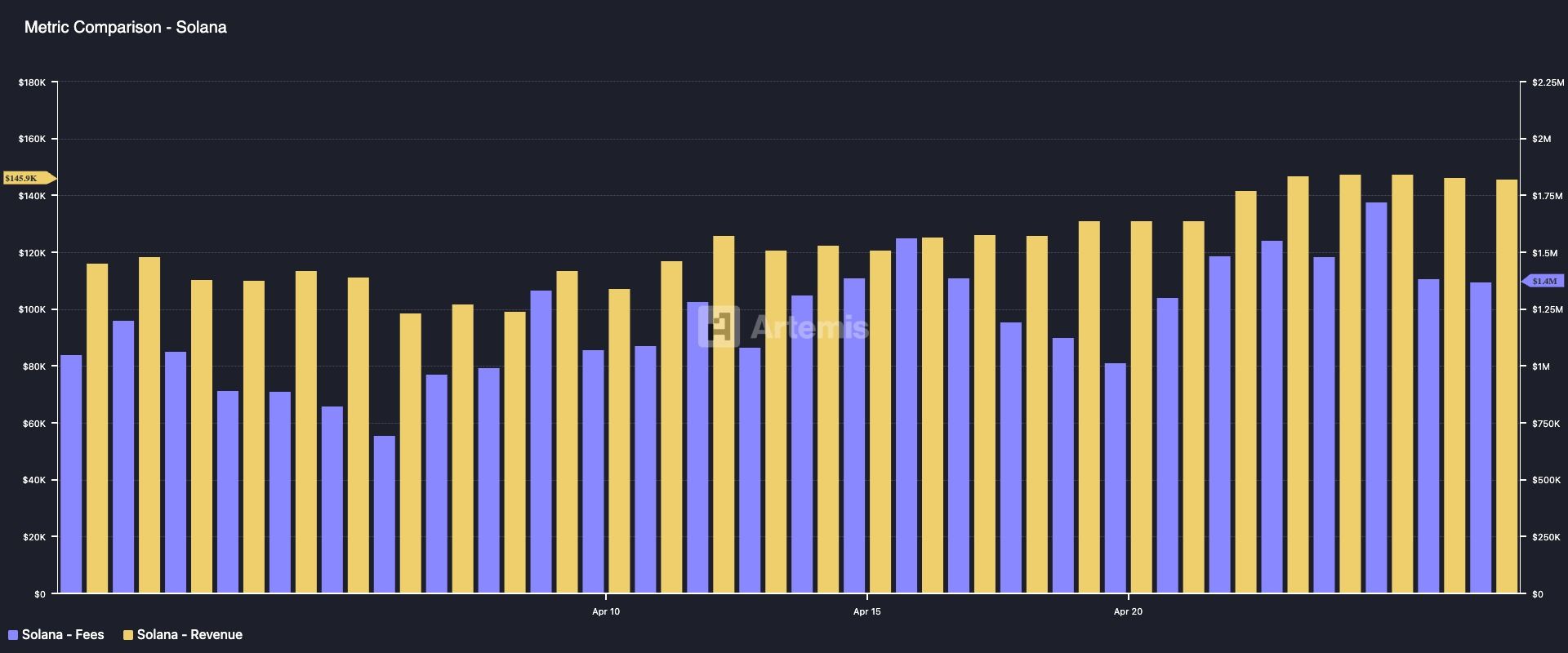

In response to this increased user’s obligation, the solana network fees and generated revenues had a significant increase. According to Artemis, the transaction costs of the network jumped by 35 %, while income from these costs received by 26 %in the same period.

In parallel, with an increase in user activity on blockchain, demand for native token, the soil was stimulated. When multiple users interact with a network, the utility token becomes increasingly popular to set transaction costs.

All these factors contributed to the increase in the soil that increased by 16 %last month. The recent increase in price reflects the growing confidence of investors in the network and emphasizes the positive correlation between the user’s activity and the token value.

Therefore, if user activity remains high on the Solana, the token could remain a bull at the beginning of the new month.

Useful pressure admits for altcoin

Currently, data on the index of direction of direction of direction (DMI) soil confirms the purchase pressure between the participants of the spot market. At the time of writing, the directional directional direction of the soil (+di, blue line) is above its negative directional index (-Di, orange line).

The DMI indicator measures the power of the asset price. It consists of two lines: +di, which represents the movement of the price up and -Di, connected to the movement of a lower price.

When +di over -di, the market is a bull with a feeling of rise that dominates the market. If this persisted, the country could extend its assembly and reach $ 171.88.

However, if blockchain users are reduced, the demand for token could be affected. The assets could even lose its latest profits if it provided support for $ 142.59.

Morality History: Solana wants to make May his second April.

Notification of irresponsibility

Notice of irresponsibility: In accordance with the Trust project Directives, this article for price analysis is intended only for information purposes and must not be considered financial or investment advice. Beincrypto undertakes to provide accurate and impartial information, but market conditions may change without prior notice. Always carry out your own research before making any financial decision and consult a professional.